4.4 Preferred Stock.

(a) The Preferred Stock may be issued from time to time in one or more series pursuant to a resolution or resolutions providing for such issue duly adopted by the Board of Directors (authority to do so being hereby expressly vested in the Board of Directors). The Board of Directors is further authorized, subject to limitations prescribed by law, to fix by resolution or resolutions and to set forth in a certification of designations filed pursuant to the DGCL the powers, designations, preferences and relative, participation, optional or other distributions paid with respectrights, if any, and the qualifications, limitations or restrictions thereof, if any, of any wholly unissued series of Preferred Stock, including without limitation authority to such Shares, unlessfix by resolution or resolutions the Administrator provides otherwise. Ifdividend rights, dividend rate, conversion rights, voting rights, rights and terms of redemption (including sinking fund provisions), redemption price or prices, and liquidation preferences of any such dividendsseries, and the number of shares constituting any such series and the designation thereof, or distributions are paid in Shares,any of the Shares will beforegoing.

(b) The Board of Directors is further authorized to increase (but not above the total number of authorized shares of the class) or decrease (but not below the number of shares of any such series then outstanding) the number of shares of any series, the number of which was fixed by it, subsequent to the issuance of shares of such series then outstanding, subject to the samepowers, preferences and rights, and the qualifications, limitations and restrictions on transferabilitythereof stated in the Certificate of Incorporation or the resolution of the Board of Directors originally fixing the number of shares of such series. If the number of shares of any series is so decreased, then the shares constituting such decrease shall resume the status which they had prior to the adoption of the resolution originally fixing the number of shares of such series.

ARTICLE V

5.1 General Powers. The business and forfeitability asaffairs of the SharesCorporation shall be managed by or under the direction of Restrictedthe Board of Directors.

5.2 Number of Directors; Election; Term.

(a) Subject to the rights of holders of any series of Preferred Stock with respect to which they were paid.

(h)Returnthe election of Restricted Stock to Company. Ondirectors, the date set forth innumber of directors that constitutes the Award Agreement,entire Board of Directors of the Restricted Stock for which restrictions have not lapsed will revert toCorporation shall be fixed solely by resolution of the Company and again will become available for grant undermajority of the Plan.

(i)Section 162(m) Performance Restrictions.Whole Board. For purposes of qualifying grantsthis Certificate of Restricted Stock as “performance-based compensation” under Section 162(m) ofIncorporation, the Code,term “Whole Board” will mean the Administrator, in its discretion, may set restrictions based upon the achievement of Performance Goal(s). The Performance Goal(s) will be set by the Administrator on or before the Determination Date. In granting Restricted Stock which is intended to qualify under Section 162(m) of the Code, the Administrator will follow any procedures determined by it from time to time to be necessary or appropriate to ensure qualification of the Award under Section 162(m) of the Code (e.g., in determining the Performance Goal(s)).

8.Restricted Stock Units.

(a)Grant. Restricted Stock Units may be granted at any time and from time to time as determined by the Administrator. Each Restricted Stock Unit grant will be evidenced by an Award Agreement that will specify such terms and conditions as the Administrator in its sole discretion determines, including all terms, conditions, and restrictions related to the grant, thetotal number of Restricted Stock Units and the form of payout, which, subject to Section 8(d), may be left to the discretion of the Administrator. Notwithstanding anything to the contraryauthorized directors whether or not there exist any vacancies in this

subsection (a), for Restricted Stock Units intended to qualify as “performance-based compensation” within the meaning of Section 162(m) of the Code, during any Fiscal Year of the Company, no Participant will receive more than an aggregate of 500,000 Restricted Stock Units; provided, however, that in connection with a Participant’s initial service as an Employee, the Participant may be granted an aggregate of up to an additional 1,000,000 Restricted Stock Units.

(b)Vesting Criteria and Other Terms. The Administrator will set vesting criteria in its discretion, which, depending on the extent to which the criteria are met, will determine the number of Restricted Stock Units that will be settled and the corresponding number of underlying Shares to be paid out to the Participant. The Administrator may set vesting criteria based upon the achievement of Company-wide, divisional, business unit, or individual goals (including, but not limited to, continued provision of services to the Company or any Parent or Subsidiary of the Company), applicable federal or state securities laws or any other basis determined by the Administrator in its discretion.

(c)Earning Restricted Stock Units. Upon meeting the applicable vesting criteria, the Participant will be entitled to receive a payout as determined by the Administrator. Notwithstanding the foregoing, at any time after the grant of Restricted Stock Units, the Administrator, in its sole discretion, may reduce or waive any vesting criteria that must be met to receive a payout.

(d)Form and Timing of Payment. Payment of earned Restricted Stock Units will be made as soon as practicable after the date(s) determined by the Administrator and set forth in the Award Agreement. The Administrator, in its sole discretion, may pay earned Restricted Stock Units in cash, Shares, or a combination of both.

(e)Cancellation. On the date set forth in the Award Agreement, all unearned Restricted Stock Units will be forfeited to the Company.

(f)Section 162(m) Performance Restrictions. For purposes of qualifying grants of Restricted Stock Units as “performance-based compensation” under Section 162(m) of the Code, the Administrator, in its discretion, may set restrictions based upon the achievement of Performance Goal(s). The Performance Goal(s) will be set by the Administrator on or before the Determination Date. In granting Restricted Stock Units which are intended to qualify under Section 162(m) of the Code, the Administrator will follow any procedures determined by it from time to time to be necessary or appropriate to ensure qualification of the Award under Section 162(m) of the Code (e.g., in determining the Performance Goal(s)).

9.Stock Appreciation Rights.

(a)Grant of Stock Appreciation Rights. Subject to the terms and conditionsrights of the Plan, a Stock Appreciation Right may be granted to Service Providers at any time and from time to time as will be determined by the Administrator, in its sole discretion.

(b)Number of Shares. The Administrator will have complete discretion to determine the number of Stock Appreciation Rights granted to any Service Provider, provided that during any Fiscal Year, no Participant will be granted Stock Appreciation Rights covering more than 1,000,000 Shares. Notwithstanding the foregoing limitation, in connection with a Participant’s initial service as an Employee, the Participant may be granted Stock Appreciation Rights covering up to an additional 2,000,000 Shares.

(c)Exercise Price and Other Terms. The per share exercise price for the Shares to be issued pursuant to exercise of a Stock Appreciation Right will be determined by the Administrator and will be no less than one hundred percent (100%) of the Fair Market Value per Share on the date of grant. Otherwise, the Administrator, subject to the provisions of the Plan, will have complete discretion to determine the terms and conditions of Stock Appreciation Rights granted under the Plan.

(d)Stock Appreciation Right Agreement. Each Stock Appreciation Right grant will be evidenced by an Award Agreement that will specify the exercise price, the term of the Stock Appreciation Right, the conditions of exercise, and such other terms and conditions as the Administrator, in its sole discretion, will determine.

(e)Expiration of Stock Appreciation Rights. A Stock Appreciation Right granted under the Plan will expire ten (10) years from the date of grant or such shorter term as may be provided in the Award Agreement, as determined by the Administrator, in its sole discretion. Notwithstanding the foregoing, the rules of Section 6(e) relating to exercise also will apply to Stock Appreciation Rights.

(f)Payment of Stock Appreciation Right Amount. Upon exercise of a Stock Appreciation Right, a Participant will be entitled to receive payment from the Company in an amount (the “Payout Amount”) determined by multiplying:

(i) The difference between the Fair Market Value of a Share on the date of exercise over the exercise price; times

(ii) The number of Shares with respect to which the Stock Appreciation Right is exercised.

At the discretion of the Administrator, the payment upon Stock Appreciation Right exercise may be in cash, in Shares (which, on the date of exercise, have an aggregate Fair Market Value equal to the Payout Amount), or in some combination thereof.

10.Performance Units and Performance Shares.

(a)Grant of Performance Units/Shares. Performance Units and Performance Shares may be granted to Service Providers at any time and from time to time, as will be determined by the Administrator, in its sole discretion. The Administrator will have complete discretion in determining the number of Performance Units and Performance Shares granted to each Participant provided that during any Fiscal Year, for Performance Units or Performance Shares intended to qualify as “performance-based compensation” within the meaning of Section 162(m) of the Code, (i) no Participant will receive Performance Units having an initial value greater than $5,000,000, and (ii) no Participant will receive more than 500,000 Performance Shares; provided, however, that in connection with a Participant’s initial service as an Employee, the Participant may be granted up to an additional 1,000,000 Performance Shares.

(b)Value of Performance Units/Shares. Each Performance Unit will have an initial value that is established by the Administrator on or before the date of grant. Each Performance Share will have an initial value equal to the Fair Market Value of a Share on the date of grant.

(c)Performance Objectives and Other Terms. The Administrator will set performance objectives or other vesting provisions (including, without limitation, continued status as a Service Provider) in its discretion which, depending on the extent to which they are met, will determine the number or value of Performance Units/Shares that will be paid out to the Participant. Each Award of Performance Units/Shares will be evidenced by an Award Agreement that will specify the Performance Period, and such other terms and conditions as the Administrator, in its sole discretion, will determine. The Administrator may set performance objectives based upon the achievement of Company-wide, divisional, business unit or individual goals (including, but not limited to, continued provision of services to the Company or any Parent or Subsidiary of the Company), applicable federal or state securities laws, or any other basis determined by the Administrator in its discretion.

(d)Earning of Performance Units/Shares. After the applicable Performance Period has ended, the holder of Performance Units/Shares will be entitled to receive a payout of the number of Performance Units/Shares earned by the Participant over the Performance Period, to be determined as a function of the extent to which the corresponding performance objectives or other vesting provisions have been achieved. After the grant of a Performance Unit/Share, the Administrator, in its sole discretion, may reduce or waive any performance objectives or other vesting provisions for such Performance Unit/Share.

(e)Form and Timing of Payment of Performance Units/Shares. Payment of earned Performance Units/Shares will be made as soon as practicable after the expiration of the applicable Performance Period. The Administrator, in its sole discretion, may pay earned Performance Units/Shares in the form of cash, in Shares (which have an aggregate Fair Market Value equal to the value of the earned Performance Units/Shares at the close of the applicable Performance Period) or in a combination thereof.

(f)Cancellation of Performance Units/Shares. On the date set forth in the Award Agreement, all unearned or unvested Performance Units/Shares will be forfeited to the Company, and again will be available for grant under the Plan.

(g)Section 162(m) Performance Restrictions. For purposes of qualifying grants of Performance Units/Shares as “performance-based compensation” under Section 162(m) of the Code, the Administrator, in its discretion, may set restrictions based upon the achievement of Performance Goal(s). The Performance Goal(s) will be set by the Administrator on or before the Determination Date. In granting Performance Units/Shares which are intended to qualify under Section 162(m) of the Code, the Administrator will follow any procedures determined by it from time to time to be necessary or appropriate to ensure qualification of the Award under Section 162(m) of the Code (e.g., in determining the Performance Goal(s)).

11.Performance-based Compensation Under Code Section 162(m).

(a)General. If the Administrator, in its discretion, decides to grant an Award intended to qualify as “performance-based compensation” under Code Section 162(m), the provisions of this Section 11 will control over any contrary provision in the Plan; provided, however, that the Administrator in its discretion may grant Awards that are not intended to qualify as “performance-based compensation” under Section 162(m) of the Code to such Participants that are based on Performance Goal(s) or other specific criteria or goals but that do not satisfy the requirements of this Section 11.

(b)Performance Goals. The granting and/or vesting of Awards of Restricted Stock, Restricted Stock Units, Performance Shares and Performance Units and other incentives under the Plan may be made subject to the attainment of performance goals relating to one or more business criteria within the meaning of Section 162(m) of the Code and may provide for a targeted level or levels of achievement (“Performance Goals”) including (i) revenue; (ii) gross margin; (iii) operating margin; (iv) operating income; (v) pre-tax profit; (vi) earnings before stock-based compensation expense, interest, taxes and depreciation and amortization; (vii) earnings before interest, taxes and depreciation and amortization; (viii) earnings before interest and taxes; (ix) net income; (x) expenses; (xi) new product development; (xii) stock price; (xiii) earnings per share; (xiv) return on stockholder equity; (xv) return on capital; (xvi) return on net assets; (xvii) economic value added; (xviii) market share; (xix) customer service; (xx) customer satisfaction; (xxi) sales; (xxii) total stockholder return; (xxiii) free cash flow; (xxiv) net operating income; (xxv) operating cash flow; (xxvi) return on investment; (xxvii) employee satisfaction; (xxviii) employee retention; (xxix) balance of cash, cash equivalents and marketable securities; (xxx) product development; (xxxi) research and development expenses; (xxxii) completion of an identified special project; (xxxiii) completion of a joint venture or other corporate transaction; (xxxiv) inventory balance; or (xxxv) inventory turnover ratio. Any criteria used may be measured, as applicable, (A) in absolute terms, (B) in combination with another Performance Goal or Goals (for example, but not by way of limitation, as a ratio or matrix), (C) in relative terms (including, but not limited to, results for other periods, passage of time and/or against another company or companies or an index or indices), (D) on a per-share or per-capita basis, (E) against the performance of the Company as a whole or a segment of the Company (including, but not limited to, any combination of the Company and any subsidiary, division, business unit, joint venture and/or other segment), and/or (F) on a pre-tax or after-tax basis. The Performance Goals may differ from Participant to Participant and from Award to Award. Prior to the Determination Date, the Administrator will determine whether any significant element(s) will be included in or excluded from the calculationholders of any Performance Goal with respect to any Participant. In all other respects, Performance Goals will be calculated in accordance with the Company’s financial statements, generally accepted accounting principles, or under a methodology established by the Administrator prior to the issuanceseries of an Award.

(c)Procedures. To the extent necessary to comply with the performance-based compensation provisions of Code Section 162(m), with respect to any Award granted subject to Performance Goal(s), within the first twenty-five percent (25%) of the Performance Period, but in no event more than ninety (90) days following the commencement of any Performance Period (or such other time as may be required or permitted by Code Section 162(m)), the Administrator will, in writing, (i) designate one or more Participants to whom an Award will be made, (ii) select the Performance Goal(s) applicable to the Performance Period, (iii) establish the

Performance Goal(s), and amounts of such Awards, as applicable, which may be earned for such Performance Period, and (iv) specify the relationship between Performance Goal(s) and the amounts of such Awards, as applicable, to be earned by each Participant for such Performance Period. Following the completion of each Performance Period, the Administrator will certify in writing whether the applicable Performance Goal(s) have been achieved for such Performance Period. In determining the amounts earned by a Participant, the Administrator will have the right to reduce or eliminate (but not to increase) the amount payable at a given level of performance to take into account additional factors that the Administrator may deem relevant to the assessment of individual or corporate performance for the Performance Period. A Participant will be eligible to receive payment pursuant to an Award for a Performance Period only if the Performance Goal(s) for such period are achieved.

(d)Additional Limitations. Notwithstanding any other provision of the Plan, any Award which is granted to a Participant and is intended to constitute qualified performance based compensation under Code Section 162(m) will be subject to any additional limitations set forth in the Code (including any amendment to Section 162(m)) or any regulations and rulings issued thereunder that are requirements for qualification as qualified performance-based compensation as described in Section 162(m) of the Code, and the Plan will be deemed amended to the extent necessary to conform to such requirements.

12.Outside Director Limitations. No Outside Director may be granted, in any Fiscal Year, Awards with a grant date fair value (determined in accordance with U.S. generally accepted accounting principles) of greater than $300,000, increased to $450,000 in the Fiscal Year of his or her initial service as an Outside Director. Any Awards granted to an individual while he or she was an Employee, or while he or she was a Consultant but not an Outside Director, will not count for purposes of the limitations under this Section 12.

13.Leaves of Absence/Transfer Between Locations. Unless the Administrator provides otherwise, vesting of Awards granted hereunder will be suspended during any unpaid leave of absence. A Participant will not cease to be an Employee in the case of (i) any leave of absence approved by the Company or (ii) transfers between locations of the Company or between the Company, its Parent, or any Subsidiary. For purposes of IncentivePreferred Stock Options, no such leave may exceed three (3) months, unless reemployment upon expiration of such leave is guaranteed by statute or contract. If reemployment upon expiration of a leave of absence approved by the Company is not so guaranteed, then six (6) months following the first (1st) day of such leave any Incentive Stock Option held by the Participant will cease to be treated as an Incentive Stock Option and will be treated for tax purposes as a Nonstatutory Stock Option.

14.Transferability of Awards. Unless determined otherwise by the Administrator, an Award may not be sold, pledged, assigned, hypothecated, transferred, or disposed of in any manner other than by will or by the laws of descent or distribution and may be exercised, during the lifetime of the Participant, only by the Participant. If the Administrator makes an Award transferable, such Award will contain such additional terms and conditions as the Administrator deems appropriate.

15.Adjustments; Dissolution or Liquidation; Change in Control.

(a)Adjustments. In the event that any dividend or other distribution (whether in the form of cash, Shares, other securities, or other property), recapitalization, stock split, reverse stock split, reorganization, reincorporation, reclassification, merger, consolidation, split-up, spin-off, combination, repurchase, or exchange of Shares or other securities of the Company, or other change in the corporate structure of the Company affecting the Shares occurs, the Administrator, in order to prevent diminution or enlargement of the benefits or potential benefits intended to be made available under the Plan, will adjust the number and class of Shares that may be delivered under the Plan and/or the number, class, and price of Shares covered by each outstanding Award, and the numerical Share limits in Sections 3, 6(b), 7(b), 8(a), 9(b) and 10(a) of the Plan.

(b)Dissolution or Liquidation. In the event of the proposed dissolution or liquidation of the Company, the Administrator will notify each Participant as soon as practicable prior to the effective date of such proposed

transaction. To the extent it previously has not been exercised, an Award will terminate immediately prior to the consummation of such proposed action.

(c)Change in Control. In the event of a Change in Control, each outstanding Award will be treated as the Administrator determines, including, without limitation, that (i) Awards may be assumed, or substantially equivalent Awards will be substituted, by the acquiring or succeeding corporation (or an affiliate thereof) with appropriate adjustments as to the number and kind of shares and prices; (ii) upon written notice to a Participant, that the Participant’s Awards will terminate upon or immediately prior to the consummation of such Change in Control; (iii) outstanding Awards will vest and become exercisable, realizable, or payable, or restrictions applicable to an Award will lapse, in whole or in part prior to or upon consummation of such Change in Control, and, to the extent the Administrator determines, terminate upon or immediately prior to the effectiveness of such merger or Change in Control; (iv) (A) the termination of an Award in exchange for an amount of cash and/or property, if any, equal to the amount that would have been attained upon the exercise of such Award or realization of the Participant’s rights as of the date of the occurrence of the transaction (and, for the avoidance of doubt, if as of the date of the occurrence of the transaction the Administrator determines in good faith that no amount would have been attained upon the exercise of such Award or realization of the Participant’s rights, then such Award may be terminated by the Company without payment), or (B) the replacement of such Award with other rights or property selected by the Administrator in its sole discretion; or (v) any combination of the foregoing. In taking any of the actions permitted under this Section 15(c), the Administrator will not be required to treat all Awards similarly in the transaction.

In the event that the successor corporation does not assume or substitute for the Award, the Participant will fully vest in and have the right to exercise all of his or her outstanding Options and Stock Appreciation Rights, including Shares as to which such Awards would not otherwise be vested or exercisable, all restrictions on Restricted Stock and Restricted Stock Units will lapse, and, with respect to Awards with performance-based vesting, all performance goals or other vesting criteria will be deemed achieved at one hundred percent (100%) of target levels and all other terms and conditions met. In addition, if an Option or Stock Appreciation Right is not assumed or substituted in the event of a Change in Control, the Administrator will notify the Participant in writing or electronically that the Option or Stock Appreciation Right will be exercisable for a period of time determined by the Administrator in its sole discretion, and the Option or Stock Appreciation Right will terminate upon the expiration of such period.

For the purposes of this subsection (c), an Award will be considered assumed if, following the Change in Control, the Award confers the right to purchase or receive, for each Share subject to the Award immediately prior to the Change in Control, the consideration (whether stock, cash, or other securities or property) received in the Change in Control by holders of Common Stock for each Share held on the effective date of the transaction (and if holders were offered a choice of consideration, the type of consideration chosen by the holders of a majority of the outstanding Shares); provided, however, that if such consideration received in the Change in Control is not solely common stock of the successor corporation or its Parent, the Administrator may, with the consent of the successor corporation, provide for the consideration to be received upon the exercise of an Option or Stock Appreciation Right or upon the payout of a Restricted Stock Unit, Performance Unit or Performance Share, for each Share subject to such Award, to be solely common stock of the successor corporation or its Parent equal in fair market value to the per share consideration received by holders of Common Stock in the Change in Control.

Notwithstanding anything in this Section 15(c) to the contrary, an Award that vests, is earned or paid-out upon the satisfaction of one or more performance goals will not be considered assumed if the Company or its successor modifies any of such performance goals without the Participant’s consent; provided, however, a modification to such performance goals only to reflect the successor corporation’s post-Change in Control corporate structure will not be deemed to invalidate an otherwise valid Award assumption.

Notwithstanding anything in this Section 15(c) to the contrary, if a payment under an Award Agreement is subject to Code Section 409A and if the change in control definition contained in the Award Agreement does not

comply with the definition of “change in control” for purposes of a distribution under Code Section 409A, then any payment of an amount that otherwise is accelerated under this Section will be delayed until the earliest time that such payment would be permissible under Code Section 409A without triggering any penalties applicable under Code Section 409A.

(d)Outside Director Awards. With respect to Awards granted to an Outside Director, in the event of a Change in Control, then the Participant will fully vest in and have the right to exercise Options and/or Stock Appreciation Rights as to all of the Shares underlying such Award, including those Shares which otherwise would not be vested or exercisable, all restrictions on Restricted Stock and Restricted Stock Units will lapse, and, with respect to Awards with performance-based vesting, all performance goals or other vesting criteria will be deemed achieved at one hundred percent (100%) of target levels and all other terms and conditions met.

16.Tax.

(a)Withholding Requirements. Prior to the delivery of any Shares or cash pursuant to an Award (or exercise thereof) or such earlier time as any tax withholding obligations are due, the Company will have the power and the right to deduct or withhold, or require a Participant to remit to the Company, an amount sufficient to satisfy federal, state, local, foreign or other taxes (including the Participant’s FICA obligation) required to be withheld and any employer tax liability shifted to a Participant with respect to such Award (or exercise thereof).

(b)Withholding Arrangements. The Administrator, in its sole discretion and pursuant to such procedures as it may specify from time to time, may permit a Participant to satisfy such tax withholding obligation, in whole or in part by (without limitation) (a) paying cash, (b) electing to have the Company withhold otherwise deliverable cash or Shares having a Fair Market Value equal to the minimum statutory amount required to be withheld, (c) delivering to the Company already-owned Shares having a Fair Market Value equal to the minimum statutory amount required to be withheld, provided the delivery of such Shares will not result in adverse accounting consequences as the Administrator determines in its sole discretion, or (d) selling a sufficient number of Shares otherwise deliverable to the Participant through such means as the Administrator may determine in its sole discretion (whether through a broker or otherwise) equal to the amount required to be withheld. The amount of the withholding requirement will be deemed to include any amount which the Administrator agrees may be withheld at the time the election is made, not to exceed the amount determined by using the maximum federal, state or local marginal income tax rates applicable to the Participant with respect to the Award on the date that the amountelection of tax to be withheld is to be determined. The Fair Market Value of the Shares to be withheld or delivered will be determined as of the date that such Shares are withheld or delivered, as applicable.

(c)Compliance With Code Section 409A. Awards will be designed and operated in such a manner that they are either exempt from the application of, or comply with, the requirements of Code Section 409A such that the grant, payment, settlement or deferral will not be subject to the additional tax or interest applicable under Code Section 409A, except as otherwise determined in the sole discretion of the Administrator. The Plan anddirectors, each Award Agreement under the Plan is intended to meet the requirements of Code Section 409A and will be construed and interpreted in accordance with such intent, except as otherwise determined in the sole discretion of the Administrator. To the extent that an Award or payment, or the settlement or deferral thereof, is subject to Code Section 409A the Award will be granted, paid, settled or deferred in a manner that will meet the requirements of Code Section 409A, such that the grant, payment, settlement or deferral will not be subject to the additional tax or interest applicable under Code Section 409A. Notwithstanding the foregoing, in no event will the Company reimburse any Participant for any taxes that may be imposed upon Participant as a result of Code Section 409A.

17.No Effect on Employment or Service. Neither the Plan nor any Award will be interpreted as forming an employment or service relationship with the Company or any Parent or Subsidiary of the Company. Neither the Plan nor any Award will confer upon a Participant any right with respect to continuing the Participant’s relationship as a Service Provider with the Company or any Parent or Subsidiary, nor will they interfere in any way with the Participant’s right or the right of the Company or any Parent or Subsidiary, as applicable, to terminate such relationship at any time, with or without cause, to the extent permitted by Applicable Laws.

18.Date of Grant. The date of grant of an Award will be, for all purposes, the date on which the Administrator makes the determination granting such Award, or such other later date as is determined by the Administrator. Notice of the determination will be provided to each Participant within a reasonable time after the date of such grant.

19.Term of Plan. Subject to Section 23 of the Plan, the Plan will become effective upon the later to occur of (a) its adoption by the Board or (b) the business day immediately prior to the Registration Date. It will continue in effect for a term of ten (10) years from the date adopted by the Board, unless terminated earlier under Section 20 of the Plan.

20.Amendment and Termination of the Plan.

(a)Amendment and Termination. The Administrator may at any time amend, alter, suspend or terminate the Plan.

(b)Stockholder Approval. The Company will obtain stockholder approval of any Plan amendment to the extent necessary and desirable to comply with Applicable Laws.

(c)Effect of Amendment or Termination. No amendment, alteration, suspension or termination of the Plan will materially impair the rights of any Participant, unless mutually agreed otherwise between the Participant and the Administrator, which agreement must be in writing and signed by the Participant and the Company. Termination of the Plan will not affect the Administrator’s ability to exercise the powers granted to it hereunder with respect to Awards granted under the Plan prior to the date of such termination.

21.Conditions Upon Issuance of Shares.

(a)Legal Compliance. Shares will not be issued pursuant to the exercise of an Award unless the exercise of such Award and the issuance and delivery of such Shares will comply with Applicable Laws and will be further subject to the approval of counsel for the Company with respect to such compliance.

(b)Investment Representations. As a condition to the exercise of an Award, the Company may require the person exercising such Award to represent and warrant at the time of any such exercise that the Shares are being purchased only for investment and without any present intention to sell or distribute such Shares if, in the opinion of counsel for the Company, such a representation is required.

22.Inability to Obtain Authority. The inability of the Company to obtain authority from any regulatory body having jurisdiction or to complete or comply with the requirements of any registration or other qualification of the Shares under any state, federal or foreign law or under the rules and regulations of the Securities and Exchange Commission, the stock exchange on which Shares of the same class are then listed, or any other governmental or regulatory body, which authority, registration, qualification or rule compliance is deemed by the Company’s counsel to be necessary or advisable for the issuance and sale of any Shares hereunder, will relieve the Company of any liability in respect of the failure to issue or sell such Shares as to which such requisite authority, registration, qualification or rule compliance will not have been obtained.

23.Stockholder Approval. The Plan will be subject to approval by the stockholders of the Company within twelve (12) months after the date the Plan is adopted by the Board. Such stockholder approval will be obtained in the manner and to the degree required under Applicable Laws.

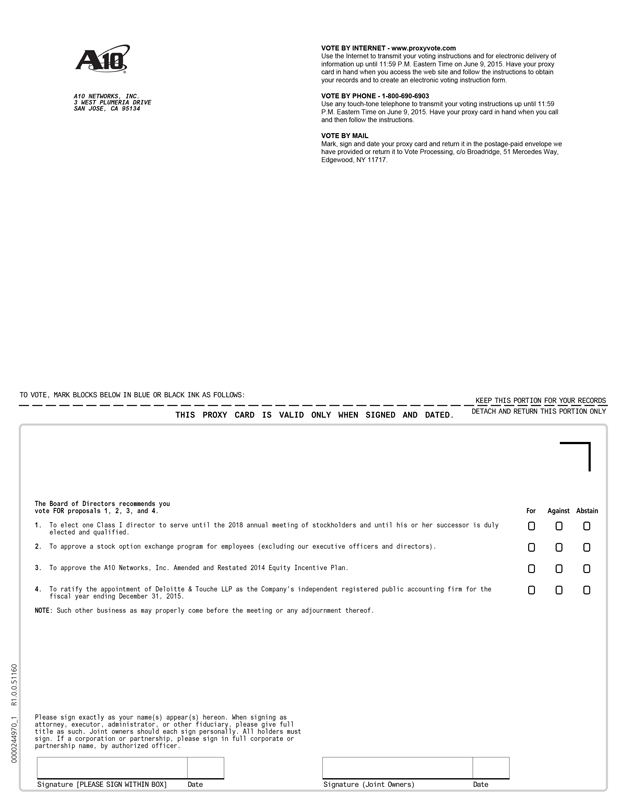

A10A10 NETWORKS, INC.3 WEST PLUMERIA DRIVE SAN JOSE, CA 95134VOTE BY INTERNET - www.proxyvote.comUse the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time on June 9, 2015. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.VOTE BY PHONE - 1-800-690-6903Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time on June 9, 2015. Have your proxy card in hand when you call and then follow the instructions.VOTE BY MAILMark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS:KEEP THIS PORTION FOR YOUR RECORDSTHIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.DETACH AND RETURN THIS PORTION ONLYThe Board of Directors recommends you vote FOR proposals 1, 2, 3, and 4.For Against Abstain1. To elect one Class I director toshall serve until the 2018 annual meeting of stockholders and until his or her successor is duly elected and qualified.2. To approvequalified or until his or her earlier death, resignation, or removal.

(c) Elections of directors need not be by written ballot unless the Bylaws of the Corporation shall so provide.

5.3 Removal. Subject to the rights of holders of any series of Preferred Stock with respect to the election of directors, a director may be removed from office by the stockholders of the Corporation only for cause and only by the affirmative vote of the holders of at least 662∕3% in voting power of the stock option exchange programof the Corporation entitled to vote thereon.

5.4 Vacancies and Newly Created Directorships. Subject to the rights of holders of any series of Preferred Stock with respect to the election of directors, and except as otherwise provided in the DGCL, vacancies occurring on the Board of Directors for employees (excluding our executive officersany reason and directors).3. To approvenewly created directorships resulting from an increase in the A10 Networks, Inc. Amended and Restated 2014 Equity Incentive Plan.4. To ratifyauthorized number of directors may be filled only by vote of a majority of the appointmentremaining members of Deloitte & Touche LLP as the Company’s independent registered public accounting firm forBoard of Directors, although less than a quorum, or by a sole remaining director, at any meeting of the fiscal year ending December 31, 2015.NOTE: Such other business as may properly come before the meeting or any adjournment thereof.Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name, by authorized officer.Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date0000244970_1 R1.0.0.51160

Important Notice Regarding the AvailabilityBoard of Proxy Materials for the Annual Meeting: The Notice & Proxy Statement, Annual Report is/are available at www.proxyvote.com.A10 NETWORKS, INC.Annual Meeting of StockholdersJune 10, 2015This proxy is solicitedDirectors. A person so elected by the Board of DirectorsThe undersigned hereby appoints Lee Chen, Greg Straughn to fill a vacancy or newly created directorship shall hold office until his or her successor shall be duly elected and Robert Cochran,qualified.

ARTICLE VI

In furtherance and eachnot in limitation of them, with fullthe powers conferred by statute, the Board of Directors of the Corporation is expressly authorized to adopt, amend or repeal the Bylaws of the Corporation by the affirmative vote of a majority of the Whole Board. Notwithstanding any other provision of this Certificate of Incorporation or any provision of law that might otherwise permit a lesser vote or no vote, but in addition to any affirmative vote of the holders of any series

A-3